This is an update to the story originally posted here.

Almost two months to the day, and I have received word back from the Washington Office of the Insurance Commissioner, and, unfortunately, I have bad (but not terrible) news.

My request to have WAC 284-30-572 updated to have gender included as a factor that cannot be used for setting rates for insurance in the state of Washington has been denied.

Now, I never assumed this would be easy. I expected to be denied right off the bat. I am, however, surprised at the reason I was denied.

According to their response, the OIC actually does not have the authority to update the rule because it would be in conflict with an actual Washington state law. Specifically RCW 48.30.300, which allows insurers to “use sex (as the term appears in statute) as a rating factor for personal home and auto coverage when “bona fide statistical differences in risk or exposure have been substantiated.”” (The fact that women are, apparently, statistically higher risk is probably the topic of another article.)

Since changing the insurance law would conflict with the state law, the OIC is at an impasse. They simply don’t have the authority. Hope isn’t lost though. In addition to urging me to contact my congress critters, the OIC’s Policy and Rules Manager, Joyce Brake, informed me of a current study being conducted by the OIC to, among other things, determine the impact of “rate factors that may have disparate impacts on Washington residents,” of which gender is a factor.

The report is due to the state legislation in November 2026. The wheels of bureaucracy move slowly. That’s not to say that our hands are tied, however. If anyone wishes to voice their opinions to their state legislators, you can find out who they are by going here.

There is still a lot of work to be done, but I wanted to thank everyone at the OIC that has honestly been a joy to work with. They have been very forthcoming with all information I have asked for, and genuinely seem to want to help. They are a great example of what a government agency should be, and though I am disappointed that the issue wasn’t so easy to resolve, I greatly appreciate that they’ve been willing to point me in the right direction in regard to actually trying to change things.

That’s it for now. Please, if you care about gender equality at all, write to your senators and representatives. Things really can change. There are people in the government that do truly want to help.

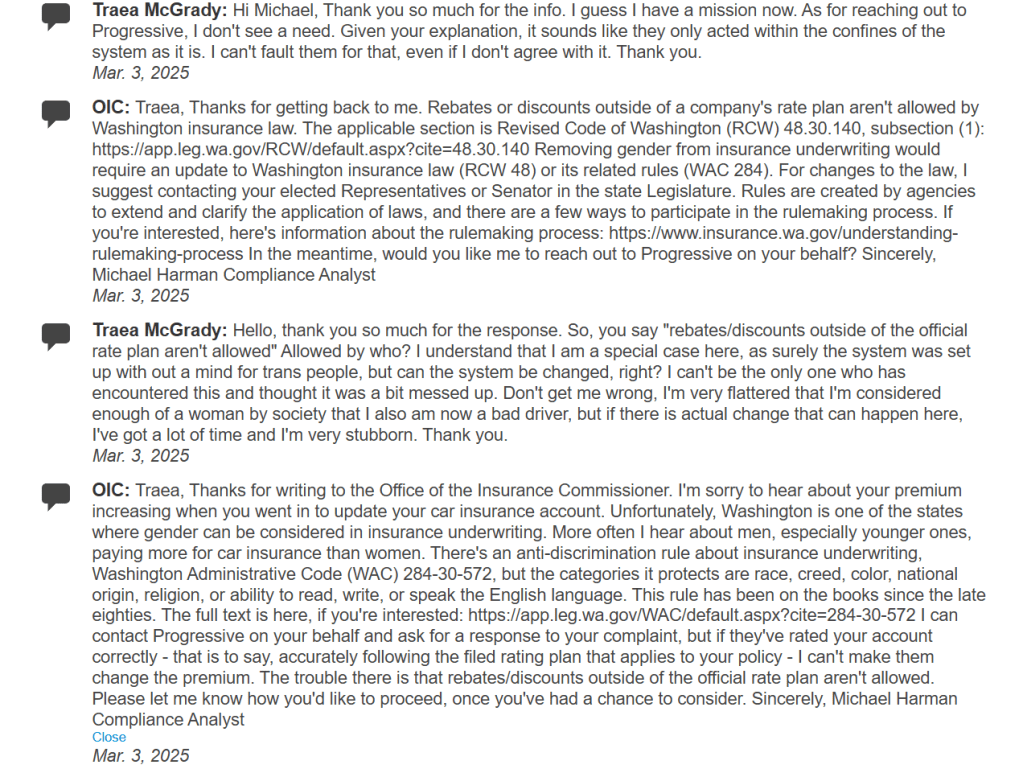

The full text of Joyce Brake’s response can be found here: